Tax Relief Act 2024 Philippines Capital – The Philippines has shelved plans to impose more taxes on junk food and sweetened beverages, its new finance chief said on Wednesday, culling the list of proposed new levies amid elevated consumer . one path to diminish their tax obligation is taking part in tax relief initiatives. Administered by the federal government and certain state entities, these programs offer various advantages .

Tax Relief Act 2024 Philippines Capital

Source : www.mondaq.com

Tax Bill For 2023? | Wolters Kluwer

Source : www.wolterskluwer.com

Read the Budget 2024 summary by Crowe Ireland | Crowe Ireland

Source : www.crowe.com

Tax Deduction Definition: Standard or Itemized?

Source : www.investopedia.com

Wolters Kluwer projects 2024 federal tax brackets and other

Source : www.wolterskluwer.com

TaxNewsFlash United States KPMG United States

Source : kpmg.com

Only 13 Cars Qualify For 2024 EV Tax Credit Under New Rules

Source : www.bloomberg.com

2022 State Tax Reform & State Tax Relief | Rebate Checks

Source : taxfoundation.org

Baker Tilly | Advisory, Tax and Assurance Baker Tilly

Source : www.bakertilly.com

Emerging trends in real estate 2024: PwC

Source : www.pwc.com

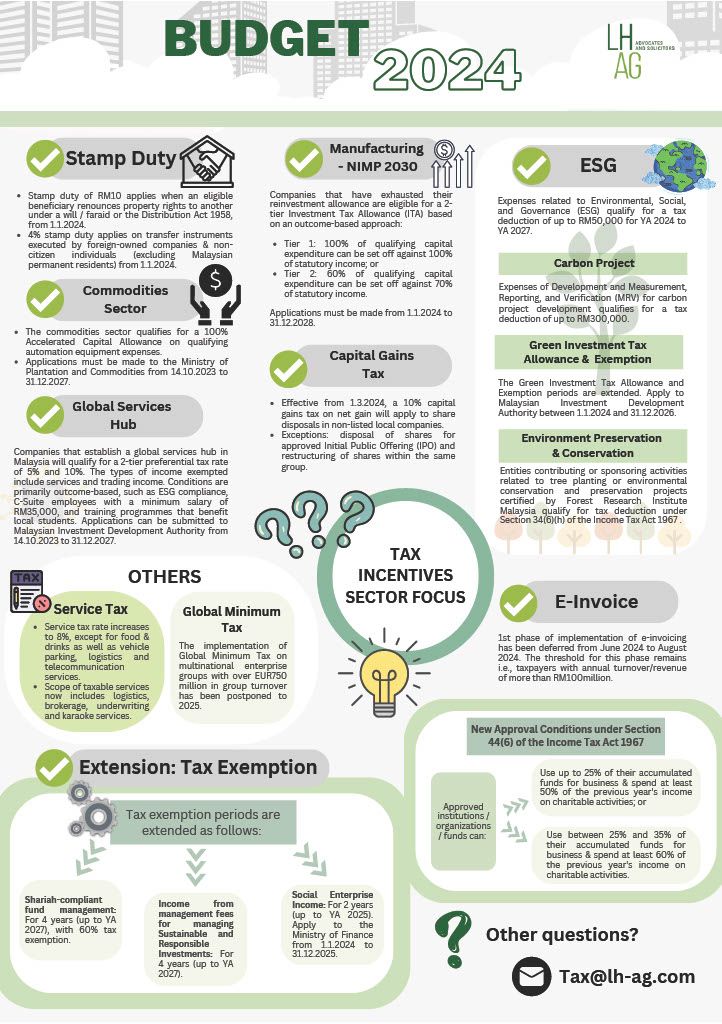

Tax Relief Act 2024 Philippines Capital TAX] Special Alert: Budget 2024 Sectoral Infographic Tax : MANILA (Reuters) – Philippine Finance Secretary Ralph Recto said on Wednesday inflation remains a “most urgent concern” and must be kept at bay. Recto, who took on the financial portfolio on Jan 15, . There is a separate set of tax brackets and rates for long-term capital gains and qualified dividends. Investors who have taxable accounts—as opposed to tax-favored retirement accounts such as .

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)