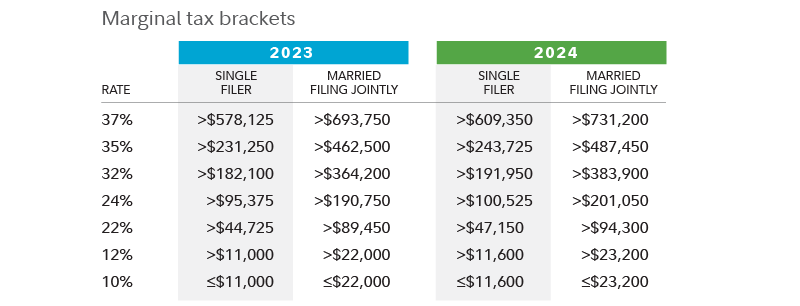

Tax Bracket Table 2024 – There are seven federal income tax rates for 2023 and 2024: 10%, 12%, 22%, 24%, 32%, 35% and 37%, depending on your taxable income and filing status. . The Internal Revenue Service (IRS) has unveiled its annual inflation adjustments for the 2024 tax year, featuring a slight uptick in income thresholds for each bracket compared to 2023. .

Tax Bracket Table 2024

Source : www.forbes.com

Projected 2024 Income Tax Brackets CPA Practice Advisor

Source : www.cpapracticeadvisor.com

IRS: Here are the new income tax brackets for 2024

Source : www.cnbc.com

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

IRS announced new tax brackets for 2024—here’s what to know

Source : www.cnbc.com

Kick Start Your Tax Planning For 2024

Source : www.benefitandfinancial.com

Tax brackets 2024| Planning for tax cuts | Fidelity

Source : www.fidelity.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

IRS Announces 2024 Income Tax Brackets. Where Do You Fall

Source : drydenwire.com

2024 Income Tax Brackets And The New Ideal Income Financial Samurai

Source : www.financialsamurai.com

Tax Bracket Table 2024 Your First Look At 2024 Tax Rates: Projected Brackets, Standard : increased the top tax bracket to $200,000 and reduced the marginal rate of tax for everyone earning between $45,000 and $200,000 to 30%. Table showing how people on different income levels would be . With the arrival of the new year 2024, the Tax Agency updates the personal income tax withholding table. In this way, it defines the percentage of income that each worker obtains in the new fiscal .